Thank you to Everydollar for sponsoring today’s conversation. All opinions are my own.

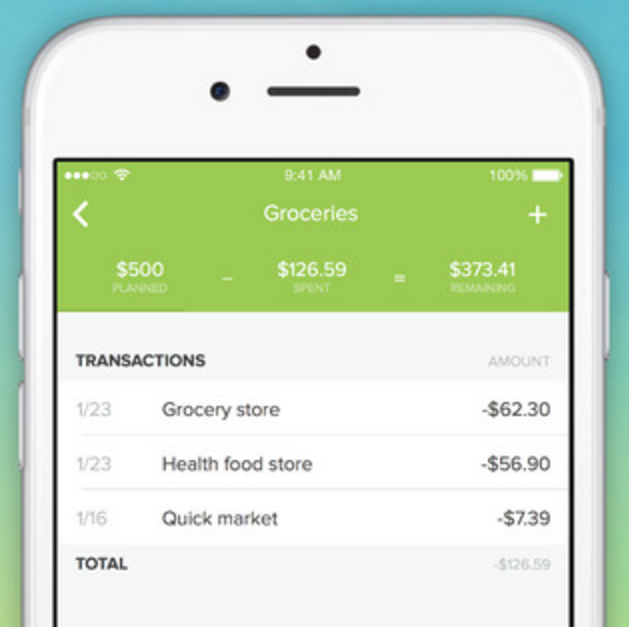

If you’ve ever considered an online budget program to keep track of your expenses and income, the Everydollar tool is a perfect choice. An online budget gives you flexibility to check your numbers from anywhere with an Internet connection, and Everydollar even offers you a great iPhone option meaning it is truly flexible from any location you may find yourself.

But why do you need an online budget at your disposal? We have a few simple answers to that important question.

Why You Should Use An Online Budget Program

You can connect and update from anywhere. An extra purchase can really throw your budget off track if not accounted for. If you happen to be on the road and make a last minute purchase decision, using an online budget program like Everydollar can make it easy to sync information so you and your spouse know exactly what is available in your budget at all times. This works especially well if you are using the envelope method and aren’t utilizing monies in your bank or savings accounts. These $5-$50 expenses can add up fast, and need to be accounted for so both spouses can track easily and know where your weekly or monthly budget stands, even if you aren’t at home.

Keeps everything together in one location. Having a spreadsheet at home isn’t easy to access if you are one your work computer all day long. Maybe you need to verify a date due, or even an amount to arrange for payments to be made. If your budget is on paper in your desk at home, or even on a spreadsheet saved only on that home computer you are out of luck when traveling or at work. An online budget program gives you access from any computer or iPhone app any time of day.

Why choose Everydollar as an online budget program?

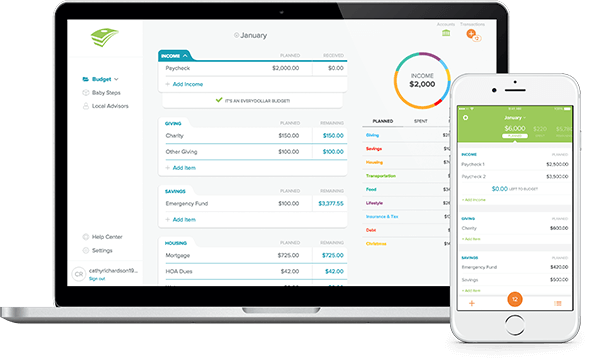

Dave Ramsey’s budgeting tips are included. There are many online budget programs out there, but Everydollar is a unique program with the fact that is has renowned financial advisor Dave Ramsey at the helm. With not only his expert tips available throughout the online budget tool, you have a simple design that is setup to match the tips available in his books and courses.

Easy to sync on iPhone app for use anywhere. Being able to sync this between your iPhone and your computer make it easy to check your budget anywhere. This online budget tool is great for use when you travel, or especially if one spouse is on the road and wants to look and see what is going on with the family budget while they are away from home.

Built in Emergency Savings plan. I love the fact that Everydollar has a built in message to include an emergency savings plan. They even pre-set your goal for $1000. This is one part of budgets that I feel is 100% necessary and not an optional budget item. Seeing this so prominent as soon as you sign up for the free online budget program makes me excited to see what else they recommended should you upgrade to the Plus version.

The Everydollar online budget program offers both a fully functional free version, as well as a plus version that allows you to link bank accounts, credit cards and more to your budget tool for easier all-in-one tracking. The free program works amazingly well, and is simple for anyone to understand how to manage. To get your budget back on track, sign up for this great tool today.

I don’t have a smartphone so this wouldn’t be of much help to me.

Sarah, the online version works just as well. Take a peak, I find it super helpful!